BLOG: Property Tax Appeal

Ohio Group Seeks to Abolish Property Taxes

Beth Blackmarr nearly fainted when she saw that her home’s assessment increased by over 50% from the prior year. That’s when she decided enough is enough and joined a movement to end all property taxes in Ohio. The group, known as Citizens for Property Tax Reform, is a grassroots campaign based in Cuyahoga County. Recently,... Read More

Florida Couple Hit with Reassessment After “Substantial Improvements”

Imagine spending a significant amount of time and money on renovating a home, only to find that the property taxes have not only doubled, not only tripled, but multiplied six times over. Although this may sound like a real estate horror tale, Florida residents Walter and Debbie have experienced this firsthand. The couple’s dream waterfront... Read More

Could Property Taxes in Florida Be a Thing of the Past?

Governor Ron DeSantis’ ambitious proposal to completely eliminate Florida property tax represents unprecedented legal and fiscal territory. As the first state to potentially abolish property taxes entirely, Florida faces complex constitutional, administrative, and economic challenges that warrant comprehensive legal analysis. Legislative Framework and Constitutional Considerations The property tax in Florida currently operates through a millage... Read More

The Key Term All Commercial Real Estate Owners Should Know

Commercial real estate owners face substantial property tax burdens that can significantly impact investment returns. However, a comprehensive understanding of obsolescence real estate principles can unlock substantial tax savings through strategic property tax appeals. This critical valuation concept often determines the success or failure of assessment challenges, yet remains underutilized by property owners seeking tax... Read More

Filing a Self-Represented Property Tax Appeal? Use Caution!

New Jersey property owners face among the highest property tax burdens in the nation, creating significant financial pressure for homeowners and businesses alike. Fortunately, the law provides a remedy through the assessment appeal process—a legal mechanism that allows taxpayers to challenge potentially excessive valuations. While the prospect of reducing one’s tax obligation is appealing, the... Read More

Paterson Kicks 5.6% Proposed Tax Hike… For Now

It turns out that when a budget proposal includes a significant property tax increase, city residents are about as thrilled as a cat in a bathtub. The mayor of Paterson’s proposed 2025 budget of $302 million, which includes a 5.6% increase in property taxes, has faced opposition from City Council members and residents who believe... Read More

New Jerseyans, Expect Tax Policy Changes in 2026

Listen up, New Jerseyans! If you haven’t heard yet, Governor Murphy unveiled his budget plan for 2026: a staggering $58.1 billion, the highest budget ever proposed in New Jersey’s history. To finance such a massive budget, the governor has recommended several revenue-raising measures, including tax policy changes. Some of these proposed changes may have implications... Read More

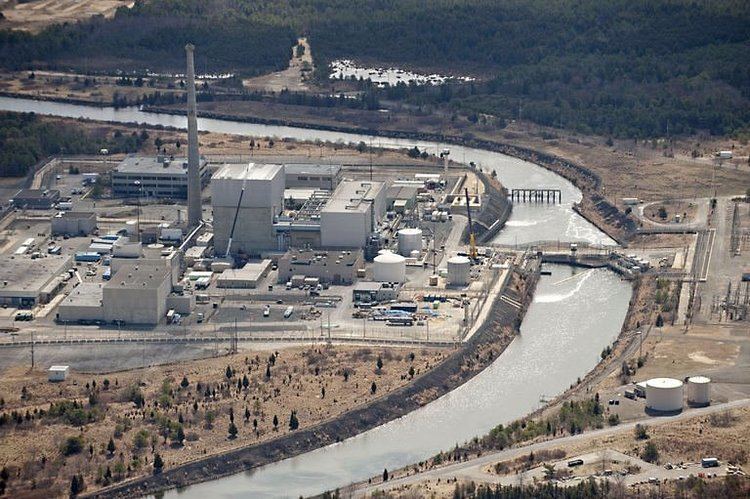

NJ Tax Court: Spent Nuclear Fuel is…Taxable!

Earlier this year, the N.J. Tax Court resolved an interesting case that intersected nuclear physics and private property rights. In a published opinion in Exelon Generation Co LLC, etc. v. Twp. of Lacey, the Court addressed a novel issue “as to whether [nuclear fuel] storage casks are taxable as real property. Property that is... Read More

How to Appeal Your Property Tax Assessment: A Comprehensive Guide

Property tax assessments serve as the foundation for determining your property tax obligations. However, these assessments often fail to reflect the true market value of your property, potentially resulting in excessive taxation. When government valuations seem inaccurate, property owners have the legal right to appeal property tax assessment determinations through established procedural channels. The Fundamental... Read More