BLOG:

Paterson Kicks 5.6% Proposed Tax Hike… For Now

It turns out that when a budget proposal includes a significant property tax increase, city residents are about as thrilled as a cat in a bathtub. The mayor of Paterson’s proposed 2025 budget of $302 million, which includes a 5.6% increase in property taxes, has faced opposition from City Council members and residents who believe... Read More

New Jerseyans, Expect Tax Policy Changes in 2026

Listen up, New Jerseyans! If you haven’t heard yet, Governor Murphy unveiled his budget plan for 2026: a staggering $58.1 billion, the highest budget ever proposed in New Jersey’s history. To finance such a massive budget, the governor has recommended several revenue-raising measures, including tax policy changes. Some of these proposed changes may have implications... Read More

Fourth Circuit Reverses Summary Judgment in Favor of Pipeline Company

This case serves as a reminder that the client usually knows more about their property that anyone else. Don’t hesitate to put them on the stand! The Fourth Circuit issued an opinion on January 27, 2025 in Mountain Valley Pipeline, LLC v. 0.32 ACRES OF LAND, Owned by Grace Minor Terry. Full opinion here: Mountain Valley... Read More

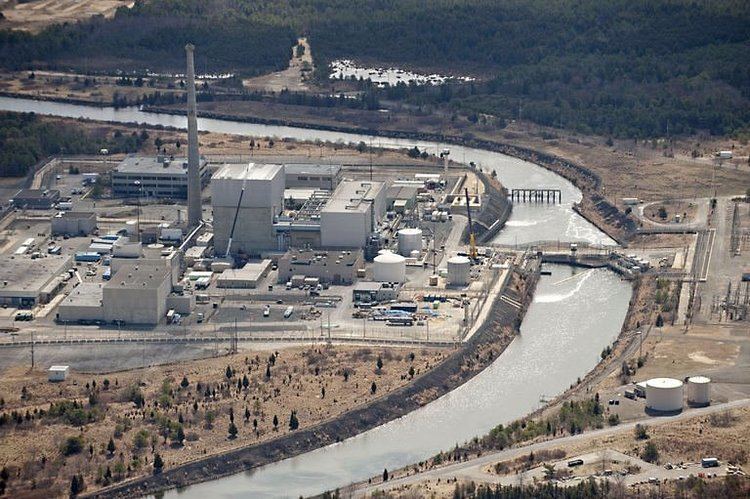

NJ Tax Court: Spent Nuclear Fuel is…Taxable!

Earlier this year, the N.J. Tax Court resolved an interesting case that intersected nuclear physics and private property rights. In a published opinion in Exelon Generation Co LLC, etc. v. Twp. of Lacey, the Court addressed a novel issue “as to whether [nuclear fuel] storage casks are taxable as real property. Property that is... Read More

Can You Fight Eminent Domain? Understanding Your Legal Rights in New Jersey

When that certified letter arrives notifying you that the government wants to take your property through eminent domain, it’s natural to feel powerless. Many property owners mistakenly believe they must simply accept whatever compensation is offered and move on. This analysis clarifies a critical point of law: property owners in New Jersey possess substantial legal... Read More

Supreme Court to Decide if Eviction Moratorium Constitutes Fifth Amendment Taking

The United States Supreme Court stands at a pivotal crossroads in property rights jurisprudence as it considers whether to hear a case that could fundamentally reshape the relationship between government emergency powers and private property rights. At issue is whether government-imposed eviction moratorium measures during the COVID-19 pandemic constituted a “taking” under the Fifth Amendment,... Read More

Extraterritorial Jurisdiction in Eminent Domain: Cornhuskers vs. Buffalos

Extraterritorial jurisdiction in eminent domain creates complex legal challenges when one state attempts to condemn property within another state’s boundaries. The ongoing dispute between Nebraska and Colorado over water rights and land acquisition along the South Platte River exemplifies this rare but significant constitutional conflict. Unlike typical eminent domain vs condemnation proceedings within a single... Read More

Appellate Court Rejects Condemnation Due to Lack of Public Use or Purpose

The New Jersey appellate court published its opinion on Friday January 31, 2025 in Township of Jackson v. Getzel Bee, LLC. Full text Getzel bee App Div 1-31-25. The court’s opinion doesn’t mince words, and poignantly states the issue at the outset: “Lots 84 and 90 are not being used for the asserted public purpose... Read More

How to Appeal Your Property Tax Assessment: A Comprehensive Guide

Property tax assessments serve as the foundation for determining your property tax obligations. However, these assessments often fail to reflect the true market value of your property, potentially resulting in excessive taxation. When government valuations seem inaccurate, property owners have the legal right to appeal property tax assessment determinations through established procedural channels. The Fundamental... Read More

Institute for Justice Seeks to Overturn Kelo v City of New London

A preeminent advocate for the rights of property owners is petitioning the United States Supreme Court to hear an eminent domain matter with the hope that it will overturn a landmark decision in eminent domain law. The Institute for Justice (IJ), a non-profit law firm dedicated to protecting the rights of property owners, represents the... Read More