Functional Units and A New Year

Rolling into a New Year here in Morristown after enduring a 14 day SARS-2/COVID-19 quarantine isolation.

Sound familiar? I bet.

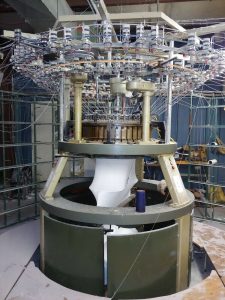

So, what do condemnation lawyers think of while sitting in isolation? Real estate valuation and property rights issues, of course! With that in mind, here’s a good one: what happens when your client’s private property is subject to a taking for public use and it includes non-traditional real estate? Like for example, a large industrial loom that is arguably moveable or relocatable.

Over fifty years ago, our NJ Supreme Court declared that –

“Where, therefore, a building and industrial machinery housed therein constitute a functional unit, and the difference between the value of the building with such articles and without them, is substantial, compensation for the taking should reflect that enhanced value. This, rather than the physical mode of annexation to the freehold is the critical test in eminent domain cases.” State v. Gallant, 42 N.J. 583, 590 (1964).

Gallant remains the only Supreme Court case adjudicating the issue. Perhaps that’s because the issue doesn’t come up all that frequently. But, if your client has a special purpose property or employs unique machinery and equipment in the use of its property, it would certainly be something to consider. Because the question is not whether the specialty equipment is moveable, the question is whether the machinery and equipment is a functional unit with the property. Most importantly, would a willing buyer and willing seller negotiating for the sale of the property consider the equipment as increasing the overall value versus the property without the equipment in place. Some other questions come to mind – did the owner have to obtain special permits or approvals to use the machinery and equipment? Or, does the location of the property affect the usefulness of the specialty equipment or the particular suitability at that location.

Gallant is certainly worth another – or first – read by real estate valuation practitioners. Our Supreme Court relied upon none other than Justice Benjamin Cardozo in framing its holding:

“Judge Cardozo was answering the State’s argument, approved in the lower court (as in the case Sub judice), that although the machine in question might be regarded as a fixture between vendor and vendee, because they were removable they were not compensable. However, the injustice of noncompensation is just as obvious, regardless of whether or not a productive machine is conceptualized as a fixture. The same loss in value is caused by condemnation in either case.”

“The value of a factory containing industrial equipment employed in the business for which the property is being used is ordinarily greater than that of an empty and idle building. Such equipment in place adds more to the value of the realty than its second-hand salvage value separated from the premises. An owner, who is under no duress, and where the building and machinery are a functional unit, would undoubtedly sell only at a price which would reflect that increased value. Where, therefore, a building and industrial machinery housed therein constitute a functional unit, and the difference between the value of the building with such articles and without them, is substantial, compensation for the taking should reflect that enhanced value. This, rather than the physical mode of annexation to the freehold is the critical test in eminent domain cases.” Gallant at 590-91.

Based on Gallant, it is certainly possible that machinery and equipment will be legally classified as real estate, even if it looks like machinery and equipment. Food for thought.

Cheers to a New Year !